If you’ve landed on this article, you probably have tons of questions about working in Finance and are wondering if this is a career path worth pursuing.

The good news is, whether you’re an entry-level finance professional or well into another industry looking for a career change, this article is for you!

In this article, we’ll be approaching topics like:

- What Are Financial Services?

- What Companies Are In The Finance Field?

- What Are The Job Options In Finance?

- What Are The Skills Needed For Finance?

- What Do Finance Jobs Pay?

- Is Finance A Good Career Path? (Our Verdict)

- How To Build A Job-Winning Finance Resume

Let’s dig in!

What Are Financial Services?

Financial services are activities designed to manage individuals' and organizations' money and investments. Banking, investment, insurance, financial planning, asset management, brokerage, corporate finance, risk management, payment and settlement services, real estate finance, tax services, and consulting are some industries focused on financial services.

This field focuses on providing the tools and advice to manage finances effectively, usually involving expert guidance and tailored solutions to address specific needs or goals.

What Companies Are In The Finance Field?

Many companies across different sectors operate in Financial Services. Here are some examples from different industries:

- Banking: Companies like JPMorgan, Chase, and Bank of America, which offer a range of banking products and services including savings accounts, loans, and mortgages.

- Investment: Firms such as BlackRock and Vanguard, which provide investment management and advisory services, including mutual funds and ETFs.

- Insurance: Organizations like AIG and Prudential, which offer various insurance products including life, health, and property insurance.

- Financial Planning: Companies like Charles Schwab and Fidelity Investments, which provide financial planning and wealth management services.

- Asset Management: Firms like Goldman Sachs and Morgan Stanley, which manage investment portfolios for individuals and institutions.

- Brokerage: Platforms such as E*TRADE and Robinhood, which facilitate the buying and selling of securities for clients.

- Corporate Finance: Companies like Deloitte and PwC, which offer corporate finance advisory services, including mergers and acquisitions and capital raising, and companies withing various industries, like consumer services, startups, big tech, and more.

- Risk Management: Organizations like Marsh & McLennan and Aon, which specialize in risk management and insurance brokerage services.

- Payment and Settlement Services: Companies like Visa and Mastercard, which provide payment processing and settlement services for transactions.

- Real Estate Finance: Firms such as CBRE and Jones Lang LaSalle, which offer real estate financing and advisory services.

- Tax Services: Companies like H&R Block and Ernst & Young, which provide tax preparation, planning, and compliance services.

- Consulting and Advisory Services: Firms like McKinsey & Company and Boston Consulting Group, which offer specialized financial consulting and advisory services.

These companies directly interact with clients through various financial services and products tailored to meet specific financial needs and goals.

What Are The Job Options In Finance?

When looking for jobs in Finance, you can either work in roles within the industry – for example, taking a Marketing position in a financial services company – or take a position that directly involves financial management and advisory.

In this section, we’ll cover the most common job options in the field.

Jobs In Investment

Investment roles involve managing and advising on investments to help clients grow their wealth. The most common roles in this area are:

- Financial/Investment Analyst (Entry-Level): Conducts research and analysis on financial data and market trends.

- Portfolio Manager (Mid-Level): Manages investment portfolios for clients, making decisions on asset allocation and investment strategies. Financial Analysts can progress into Portfolio Manager roles.

- Investment Banker (Mid-Senior Level): Provides advisory services on mergers, acquisitions, and capital raising. Financial Analysts can progress into Investment Banker roles.

Jobs In Financial Planning

Financial Planning roles involve helping individuals and businesses plan their finances and achieve their financial goals. The most common roles in this area are:

- Financial Planner (Entry-Level): Provides advice on budgeting, savings, and investments.

- Wealth Manager (Mid-Level): Manages high-net-worth clients' portfolios and financial plans. Financial Planners can progress into Wealth Manager roles.

- Certified Financial Planner (Mid-Senior Level): Offers comprehensive financial planning services, often requiring certification. Financial Planners can progress into Certified Financial Planner roles with additional qualifications.

Jobs In Corporate Finance

Corporate Finance roles involve managing a company’s financial activities, including capital raising and financial planning. Professionals working in corporate finance can take roles in various industries, such as consumer services, startups, big tech, and more. The most common roles in this area are:

- Financial Analyst (Entry-Level): Analyzes financial data and supports decision-making.

- Finance Manager (Mid-Level): Oversees financial planning, analysis, and reporting. Financial Analysts can progress into Finance Manager roles.

- Chief Financial Officer (Senior Level): Manages the overall financial strategy of an organization. Finance Managers can progress into Chief Financial Officer roles.

These roles directly involve financial expertise and management, offering various career paths and opportunities for advancement within the finance sector.

What Are The Skills Needed For Finance?

You don't necessarily need a degree or experience to fill a position in Finance. However, learning the skills required for each position is very important. Not only because you might need to work on your skill gaps, but also because you might have well-developed skills you can leverage to take a new role.

Here are the required skills for the most common roles in Finance:

Entry-Level Roles:

- Analytical Skills: The ability to analyze financial data and market trends.

- Excel Proficiency: Strong skills in using Excel for financial modeling and data analysis.

- Attention to Detail: Accuracy in handling financial information and transactions.

- Communication: The ability to communicate financial information clearly both verbally and in writing.

- Basic Accounting Knowledge: Understanding of accounting principles and financial statements.

- Problem-Solving: The ability to identify and solve financial issues efficiently.

Mid-Level Roles:

- Advanced Analytical Skills: Proficiency in financial analysis and complex data interpretation.

- Financial Modeling: Ability to build and analyze financial models to support decision-making.

- Client Relationship Management: Skills in managing client relationships and providing tailored financial advice.

- Risk Assessment: Ability to identify and assess financial risks.

- Certifications: Relevant certifications such as CFA, CFP, or CPA can be beneficial.

- Project Management: Skills in managing financial projects and coordinating with various stakeholders.

Mid-Senior Roles:

- Leadership: The ability to lead, motivate, and manage a finance team.

- Strategic Thinking: The ability to develop and implement financial strategies that align with the company's long-term goals.

- Data Analysis: Advanced skills in analyzing financial data and performance metrics to improve financial decision-making.

- Communication: Strong verbal and written communication skills in presenting financial reports and strategies.

- Budgeting and Forecasting: Expertise in creating and managing budgets and financial forecasts.

- Regulatory Knowledge: Understanding of financial regulations and compliance requirements.

Companies also love candidates who are ethical, detail-oriented, and have strong interpersonal skills!

Finding Your Fit With Finance Roles

Want to find out if you have the right fit for a Finance role?

We've got you covered.

Here's a simple, step-by-step guide to find out if you have the skills to take a new position in Finance!

- Head over to LinkedIn and search for Finance roles

- Copy the job description of that Finance role that sparked your interest

- Head over to ResyMatch.io (or use our shortcut below)

- Grab a copy of your most updated resume

- Upload your resume on the left side

- Paste the job description on the right side

- Hit “Start Resume Scan”

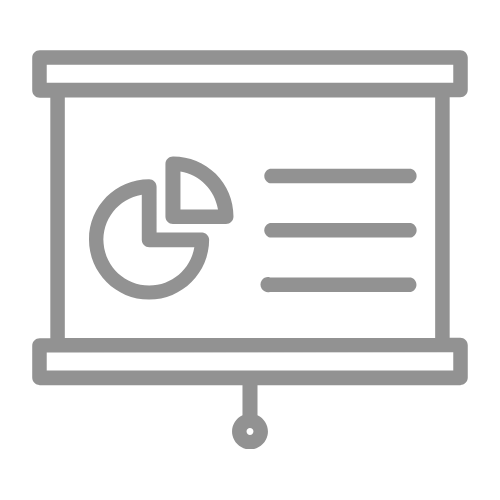

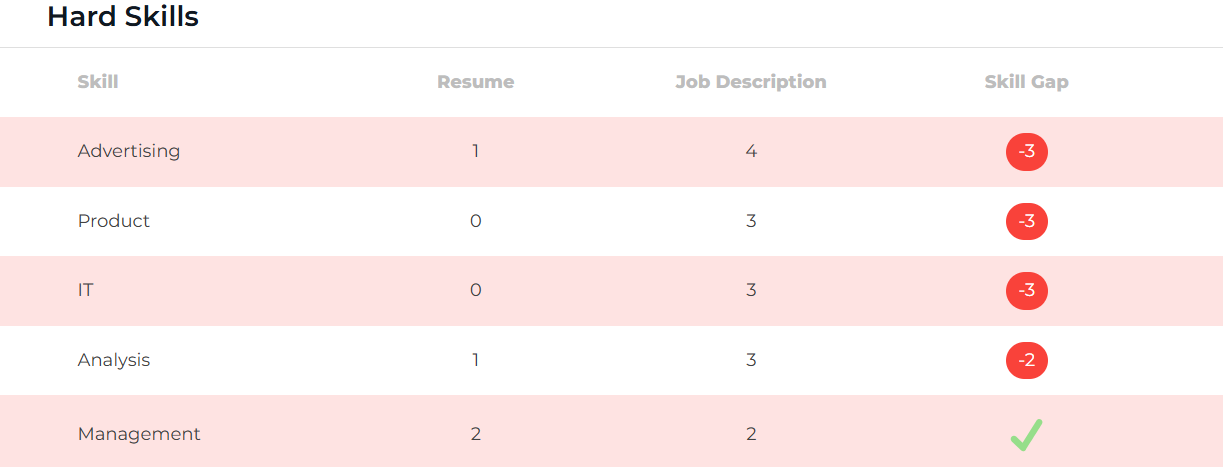

Boom! ResyMatch will compare and score your resume versus the job's description and find missing skill gaps, like such:

ResyMatch will also check your resume for ATS, a software that recruiters use to track candidates through their hiring process, and provide best practices to improve your resume!

Use our shortcut below to get started:

What Do Finance Jobs Pay?

Now that we’ve covered the most common jobs in Finance, you might be asking yourself what the pay range is for these roles.

To answer this question, let’s head over to one of our favorite tools for salary research: Glassdoor.

Glassdoor is one of the world’s top job and recruiting websites, where users can anonymously provide information about their companies – including their current salary. Glassdoor provides an average salary range for various roles based on the information sent by its users.

According to Glassdoor, the base salary for the most common Finance jobs in 2026 are:

- Financial/Investment Analyst: US$ 67K – US$ 112K/ year

- Portfolio Manager: US$ 70K – US$ 127K/ year

- Investment Banker: US$ 130K – US$ 243K/ year

- Financial Planner: US$ 61K – US$ 114K/ year

- Wealth Manager: US$ 80K – US$ 149K/ year

- Certified Financial Planner: US$ 77K – US$ 143K/ year

- Financial Analyst: US$ 63K – US$ 100K/ year

- Finance Manager: US$ 96K – US$ 153K/ year

- Chief Financial Officer (CFO): US$ 144K – US$ 265K/ year

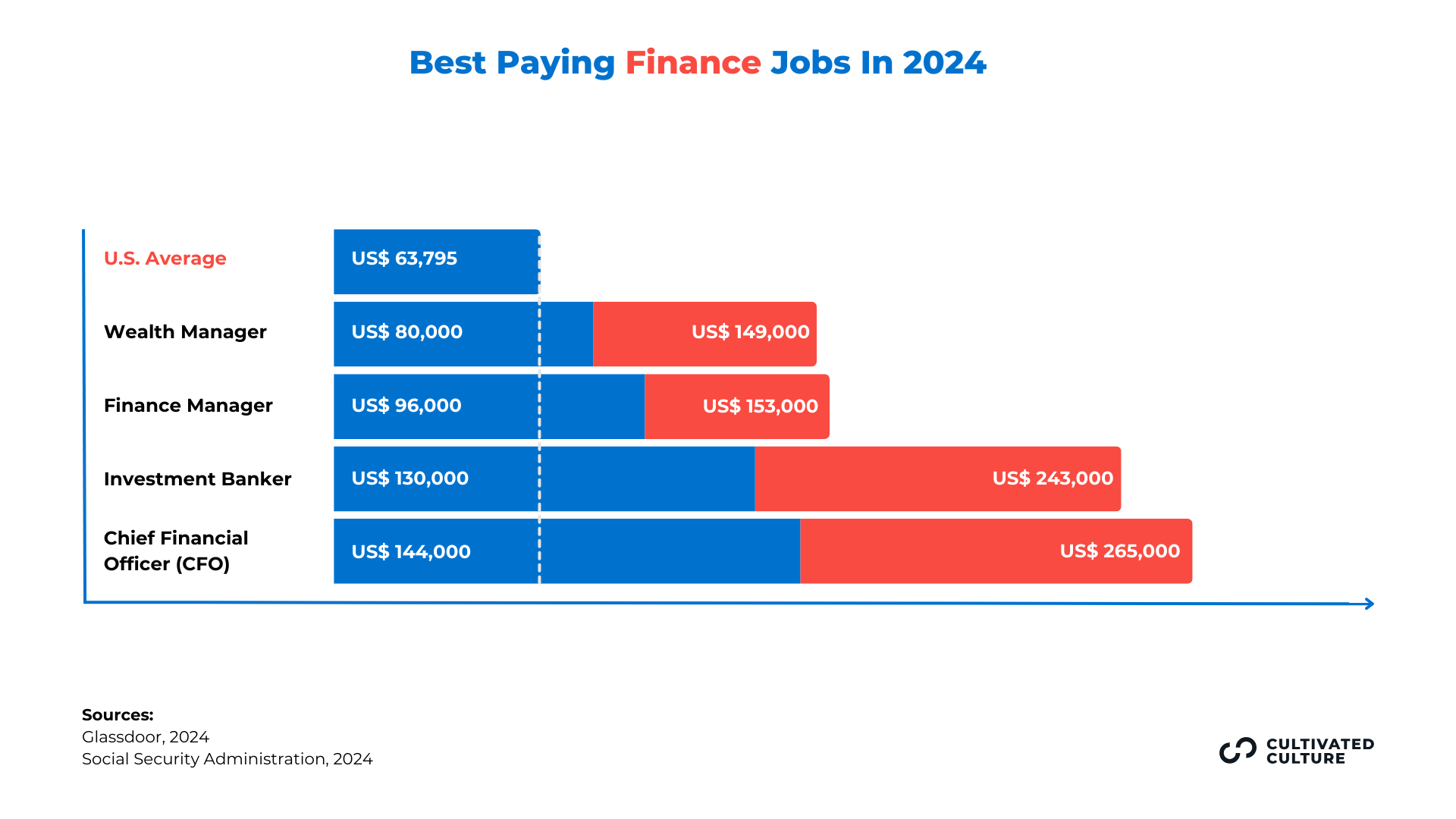

Best Paying Jobs In Finance Compared To The Average U.S. Salary In 2026

Now, let’s check what that looks like compared to the average U.S. salary.

According to the Social Security Administration, the average salary in the U.S. is US$ 63,795.

This is what the best-paying jobs in Finance look like when we put them in perspective:

Wealth Manager, Finance Manager, Investment Banker, and Chief Financial Officer (CFO) are the highest-paying roles in Finance, with an earning potential of up to 315% higher than the U.S. average.

Now that we've got all of the most important information converted, it's time to answer the question that drove you to this article:

Is Finance A Good Career Path? (Our Verdict)

Finance is a good career path for people with an interest in numbers, analysis, and strategic decision-making.

Finance roles are focused on managing and optimizing financial resources, meaning professionals in this field work hard to provide clients and organizations with sound financial advice and management. JPMorgan Chase, Goldman Sachs, and Vanguard are some examples of companies in the finance sector.

Companies in this field offer many entry-level positions that provide opportunities for growth and professional development. Additionally, finance careers often come with competitive salaries, with mid to senior roles potentially paying over $150,000 or more per year.

If you feel like this might be the career path for you, then pay close attention to this next section, because we'll be covering…

How To Build A Job-Winning Finance Resume

Here's a fact most people don't usually realize: you don't need traditional experience to take a Finance role.

You can leverage your unique background, experiences, and skills for nearly any position, as long as you sell it.

Think about your resume as an advertisement for yourself. Like any ad, you want it to be compelling and visually attractive, right?

That's what you'll do with your resume.

You will start by:

1. Leveraging The Best Keywords For Your Target Role

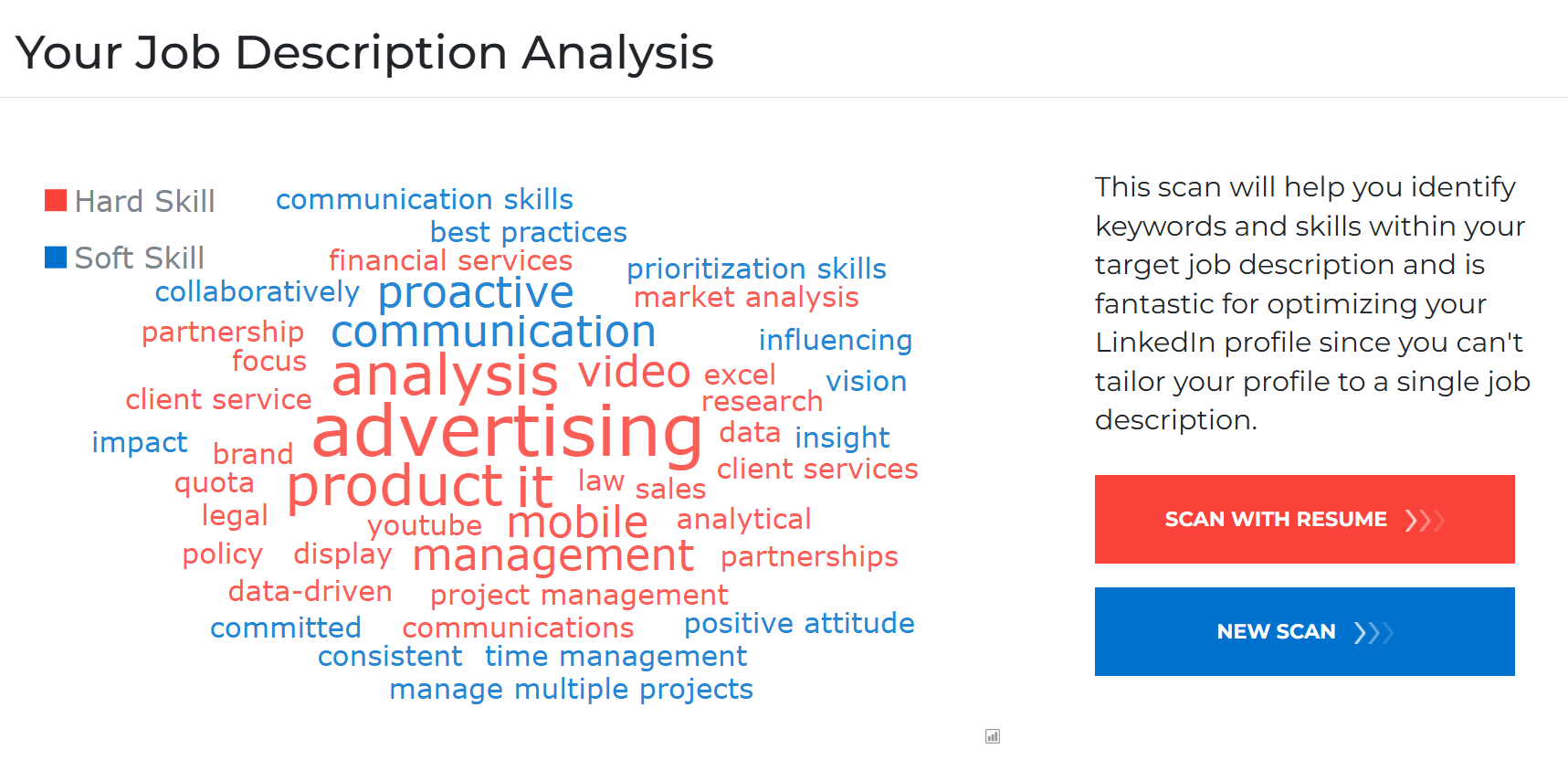

Remember ResyMatch.io, that resume and job description scanner tool we mentioned earlier in this article?

We first showed you how you can scan and compare your resume with your target job description to find out how your skills match the role.

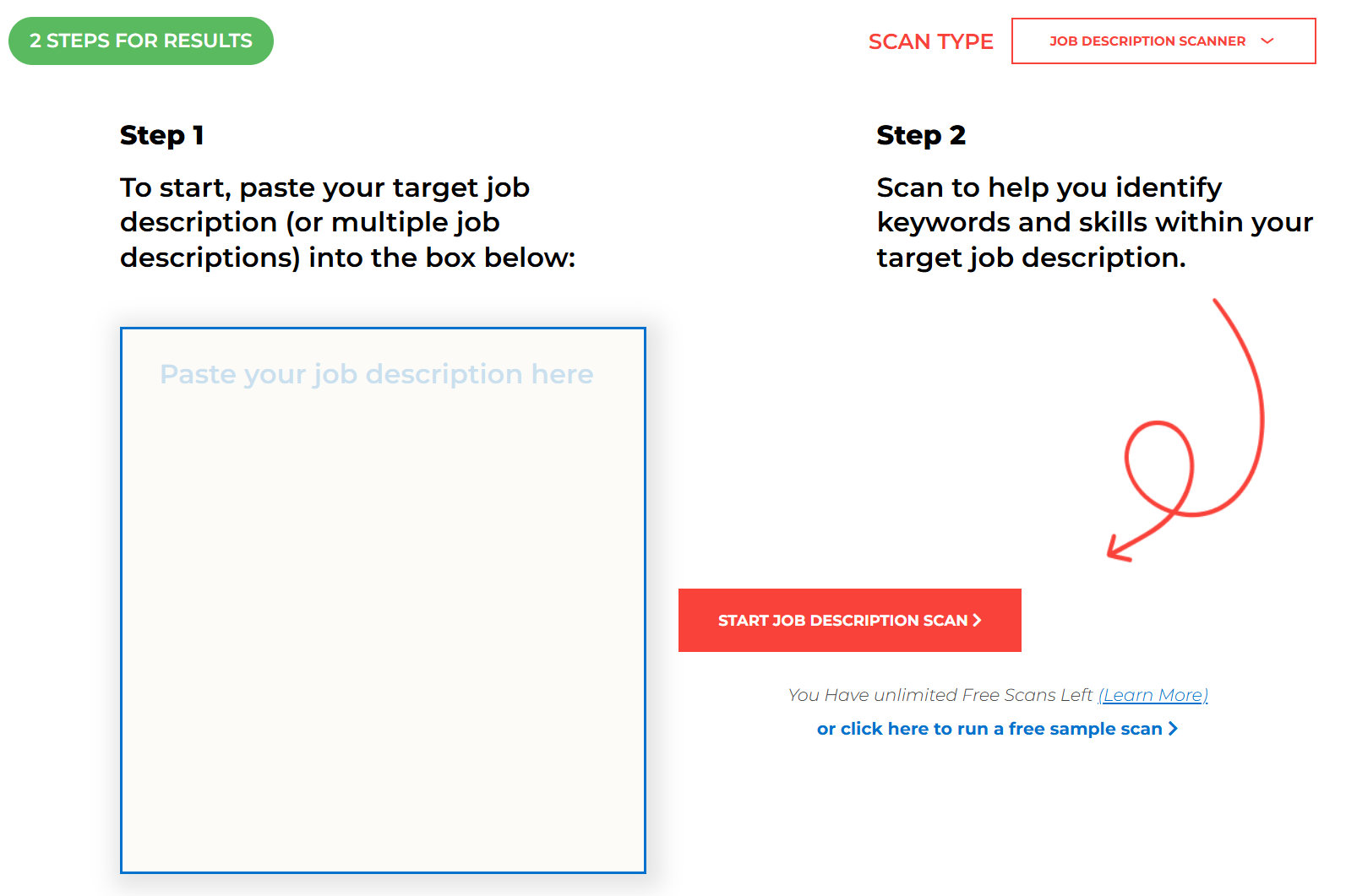

But if you don't have a resume, you can find out the most required skills and keywords for your target role by running a job description scan.

Here's how: head over to ResyMatch.io and, in “Scan Type”, select “Job Description Scanner”. Then, copy the job description for your target role and paste it into the box on the left.

ResyMatch.io will provide a list of soft and hard skills most required for that role, which serve as keywords:

Skim through the list and check what keywords you could leverage in your resume.

For example, let's say you are a proactive and communicative individual. Are there any previous experiences, personal projects, or even academic achievements that you can showcase in your resume that prove this?

If the answer is “yes”, then hold on to these keywords and move to the next step, which is:

2. Writing Compelling Resume Bullets

This is where you'll start crafting a resume that sells!

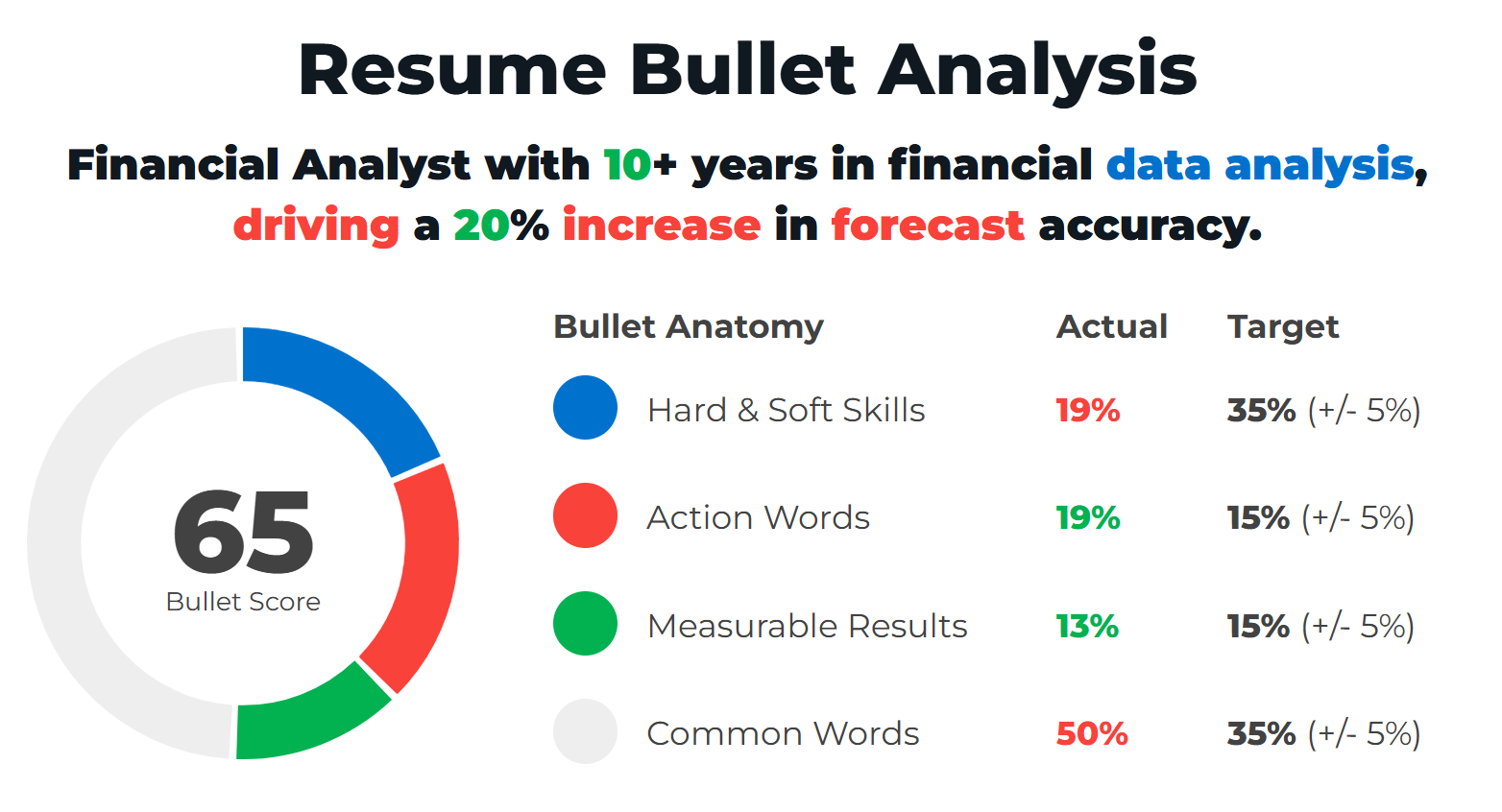

You'll want your resume bullets to have just the right amount of hard and soft skills, action words, measurable results, and common words.

This means a compelling Finance resume bullet for someone applying for a Financial Analyst role might look something like this:

“Financial Analyst with 10+ years in financial data analysis, driving a 20% increase in forecast accuracy..”

This bullet focuses on specific Financial Analyst hard and soft skills, while also showcasing measurable results!

To help you write the perfect resume bullet, we've created ResyBullet.io, a free resume bullet analyzer that helps you write your resume in a way that grabs attention and illustrates value. Simply copy and paste your resume bullet below to begin your analysis:

ResyBullet will analyze and score your resume bullet and give you actionable insights for improvement.

Here's how our Finance resume bullet scored on ResyBullet:

If you're a visual learner, check out our video that walks you through the step-by-step of writing a crazy-effective resume bullet:

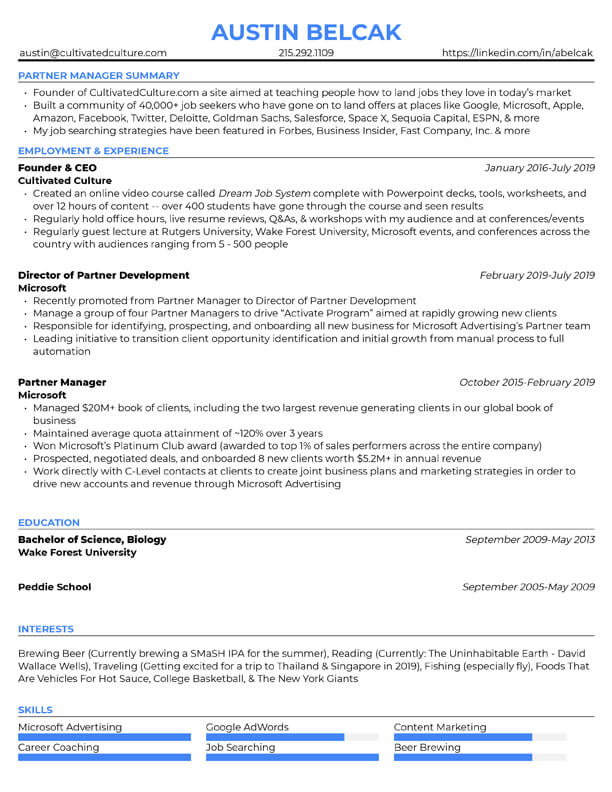

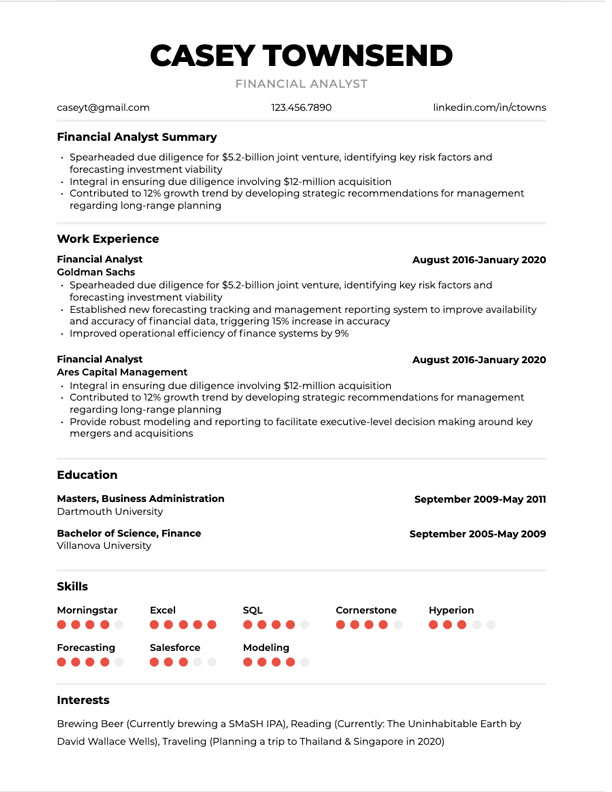

3. Turning Your Resume Visually Appealing

The last step is wrapping all that up into an awesome layout. Our advice is to use a resume template so you can spare the time you'd normally spend designing and diagramming your resume and allocate it to your job search.

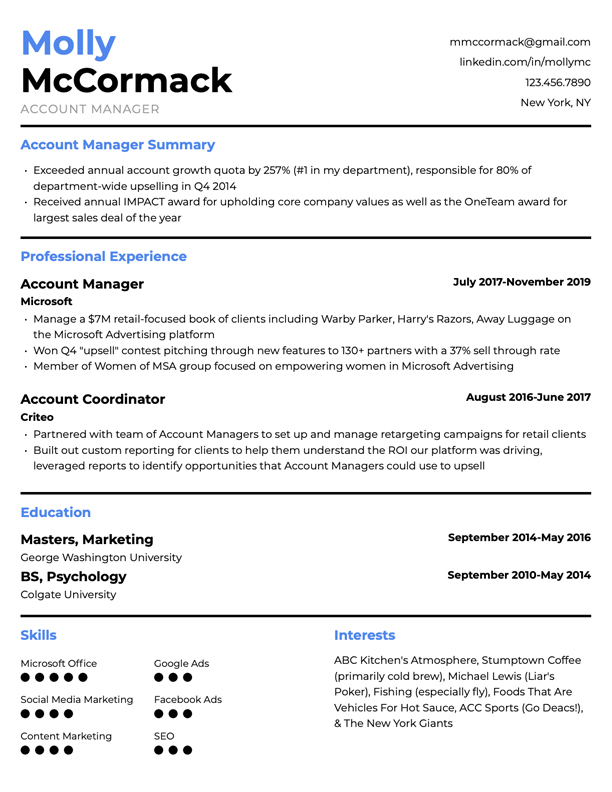

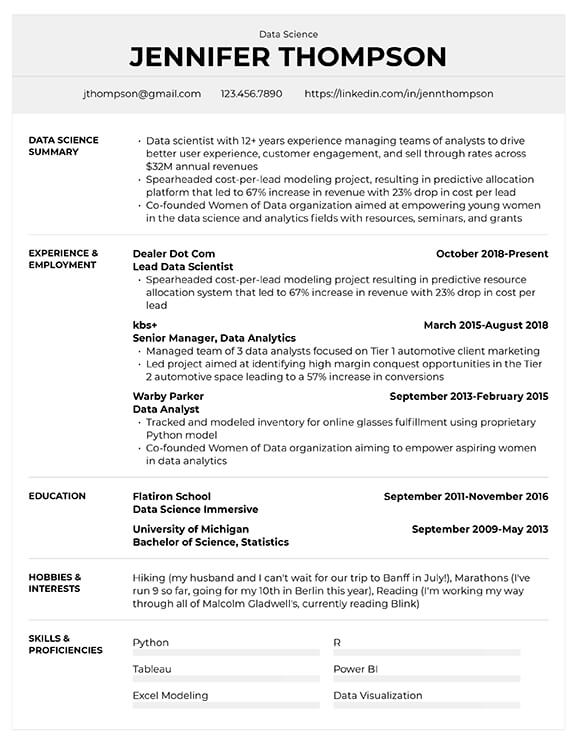

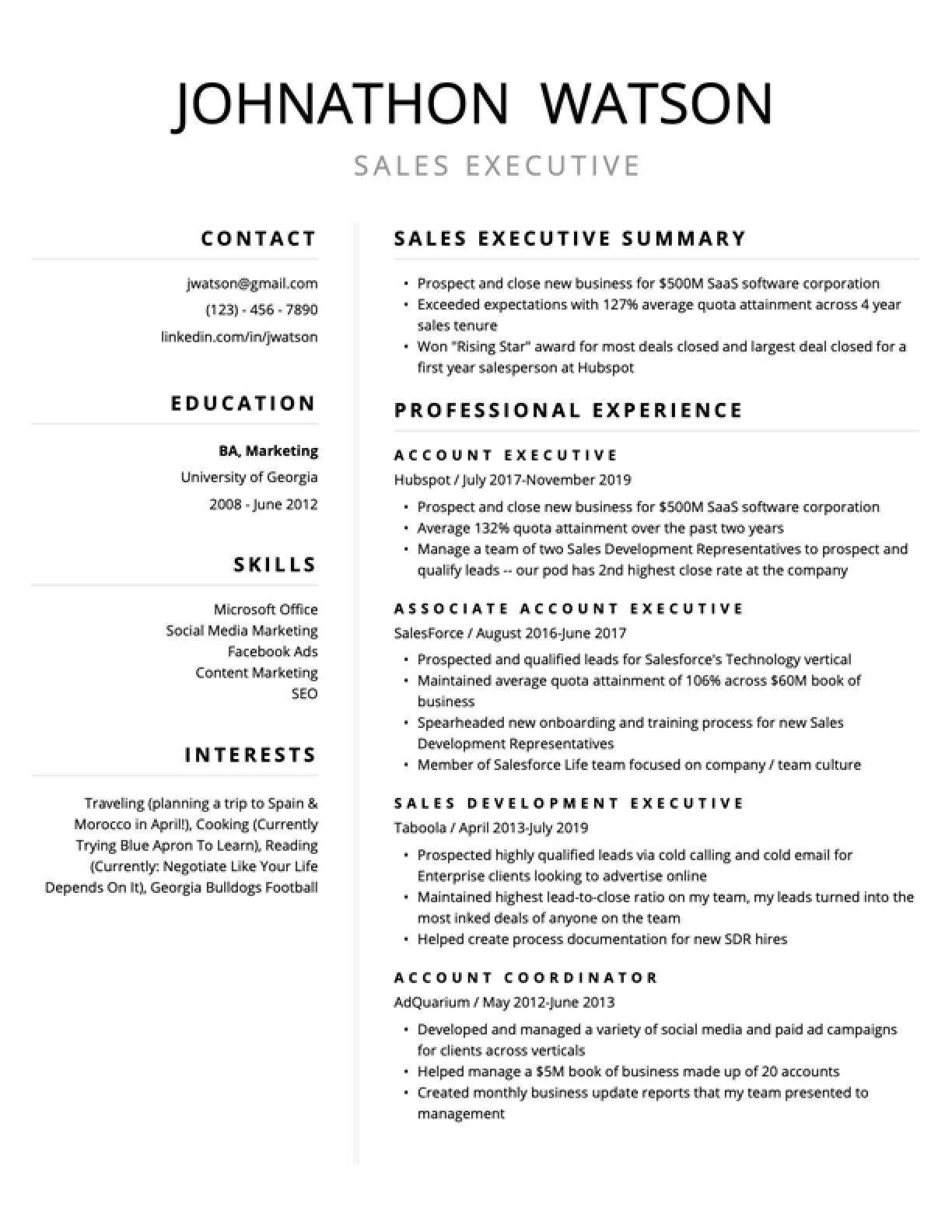

You can use ResyBuild.io to easily build and customize your resume in no time. Just pick one of the templates below and get started:

Free Job-Winning Resume Templates, Build Yours In No Time.

Choose a resume template below to get started:

Pro Tip: For more insight, check out our article: Financial Analyst Resume Examples For 2024 (20+ Skills & Templates)

Ready To Track A Finance Career Path?

Then check out our No Experience, No Problem course and access a proven framework for building the skills and results you need to break into a new industry (even if you have absolutely no relevant experience right now)!