If you’ve landed on this article, you probably have tons of questions about working in the major banks industry and are wondering if this is a career path worth pursuing.

Good news – you have come to the right place! Whether you're an entry-level professional or well-established in another industry and looking for a career change, this article is for you!

In this article, we’ll be covering the following topics:

- What Is The Major Banks Industry?

- What Companies Are In The Major Banks Field?

- What Are The Job Options In Major Banks?

- What Are The Skills Needed For Major Banks?

- What Do Major Banks Jobs Pay?

- Is Major Banks A Good Career Path? (Our Verdict)

- How To Build A Job-Winning Major Banks Resume

Let’s dig in!

What Is The Major Banks Industry?

Major banks represent large financial institutions that provide a wide range of financial services, including savings and checking accounts, loans, credit, and investment management. These institutions serve both individuals and businesses, helping to facilitate financial growth, stability, and transactions within the economy.

Companies in this field play a critical role in the global financial system, managing billions of dollars in assets and providing essential services that support other industries and individuals alike.

What Companies Are In The Major Banks Field?

Many companies operate in the major banks industry. Here are some examples from different regions:

- United States: Companies like JPMorgan Chase, Bank of America, and Wells Fargo lead the market in banking and financial services.

- Europe: Companies like HSBC, Barclays, and BNP Paribas are significant players in the European banking sector.

- Asia: Major banks such as Mitsubishi UFJ Financial Group, Industrial and Commercial Bank of China, and DBS Group dominate banking in Asia.

These companies are involved in various aspects of banking and finance, from retail and commercial banking to wealth management and investment services.

What Are The Job Options In Major Banks?

When looking for jobs in the major banks industry, you can either work in traditional banking roles – for example, taking on a customer service role in a bank branch – or take a position that deals with more specialized functions such as financial analysis, risk management, or investment banking.

In this section, we’ll cover the most common job options in finance, risk, and investment.

Jobs In Customer Service & Retail Banking

Customer service and retail banking roles focus on assisting clients with everyday banking needs. The most common roles in this area are:

- Bank Teller: Handles customer transactions, including deposits, withdrawals, and check cashing.

- Personal Banker: Assists clients with opening accounts, securing loans, and advising on financial products.

- Branch Manager: Oversees operations and staff in a bank branch, ensuring quality service and regulatory compliance.

Jobs In Corporate & Investment Banking

Roles in corporate and investment banking cater to larger business clients, assisting them with mergers, acquisitions, and complex financial transactions. The most common roles in this area are:

- Investment Banker: Provides financial advisory services for mergers, acquisitions, and other corporate finance activities.

- Financial Analyst: Analyzes financial data to assist in decision-making for high-stakes investments.

- Portfolio Manager: Manages investment portfolios for large clients, balancing risks and returns.

Jobs In Risk Management & Compliance

Risk management and compliance roles focus on ensuring that banks adhere to financial regulations and effectively manage financial risk. The most common roles in this area are:

- Risk Analyst: Evaluates financial risk and creates strategies to mitigate potential losses.

- Compliance Officer: Ensures the bank adheres to financial regulations and anti-money laundering laws.

- Internal Auditor: Reviews financial records and procedures to safeguard the bank against regulatory issues.

What Are The Skills Needed For Major Banks?

Learning the skills required for each position is very important. You might have to address some skill gaps or you may already have well-developed skills that you can leverage as you seek a new role.

Here are the required skills for the most common roles in the major banks industry:

Entry-Level Roles:

- Communication Skills: Essential for roles that involve customer interactions, like banking and financial advising.

- Attention to Detail: Necessary for handling financial transactions and maintaining regulatory compliance.

- Numerical Skills: Important for accurately managing and analyzing financial data.

Mid-Senior Manager Roles:

- Leadership: The ability to lead, motivate, and manage teams across various departments.

- Strategic Thinking: Developing long-term plans to meet financial goals and respond to market changes.

- Regulatory Knowledge: Understanding banking regulations to ensure compliance in all transactions.

Mid-Senior Technical Roles:

- Data Analysis: Using data to make informed decisions on investments, risks, and client services.

- Risk Management Expertise: In-depth knowledge of identifying and mitigating financial risks.

- Financial Modeling: The ability to develop and interpret complex financial models.

Finding Your Fit With Major Banks Roles

Want to find out if you are the right fit for a role in the major banks industry?

We've got you covered.

Here's a simple, step-by-step guide to find out if you have the skills to take a new position in the major banks industry!

- Head over to LinkedIn and search for major banks industry roles.

- Copy the job description of the role that sparked your interest.

- Head over to ResyMatch.io (or use our shortcut below)

- Grab a copy of your most updated resume.

- Upload your resume on the left side.

- Paste the job description on the right side.

- Hit “Start Resume Scan.”

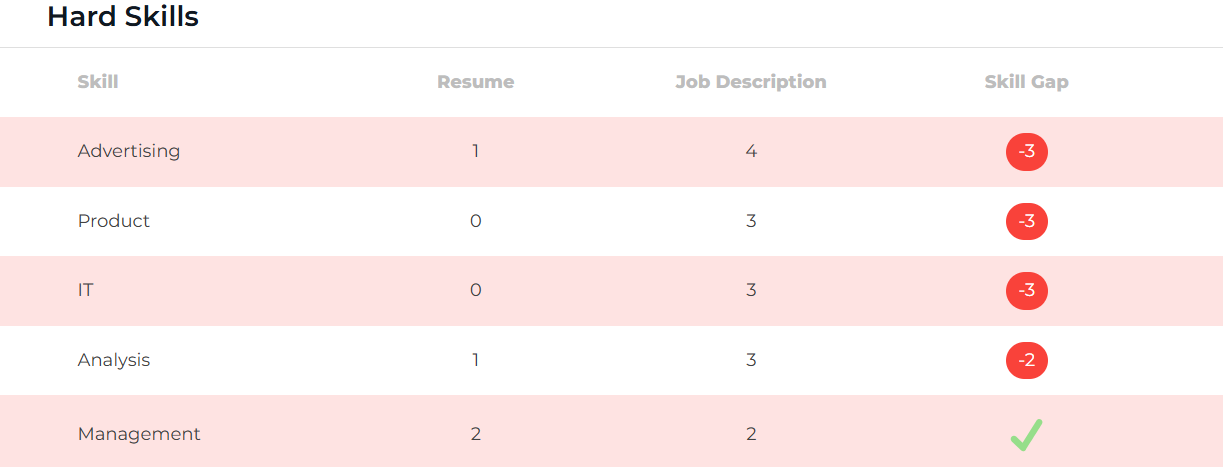

Boom! ResyMatch will compare and score your resume versus the job description and identify skill gaps.

ResyMatch will also provide best practices you can use to improve your resume and will ensure that your resume is ATS compliant (ATS is a software that recruiters use to track candidates through their hiring process).

Use our shortcut below to get started:

What Do Major Banks Jobs Pay?

Now that we’ve covered the most common jobs in the major banks industry, you might be wondering how much these roles pay.

To answer this question, let’s head over to one of our favorite tools for salary research: Glassdoor.

Glassdoor is one of the world’s top job and recruiting websites where users can anonymously provide information about their companies – including their current salary. Glassdoor provides an average salary range for various roles based on the information sent by its users.

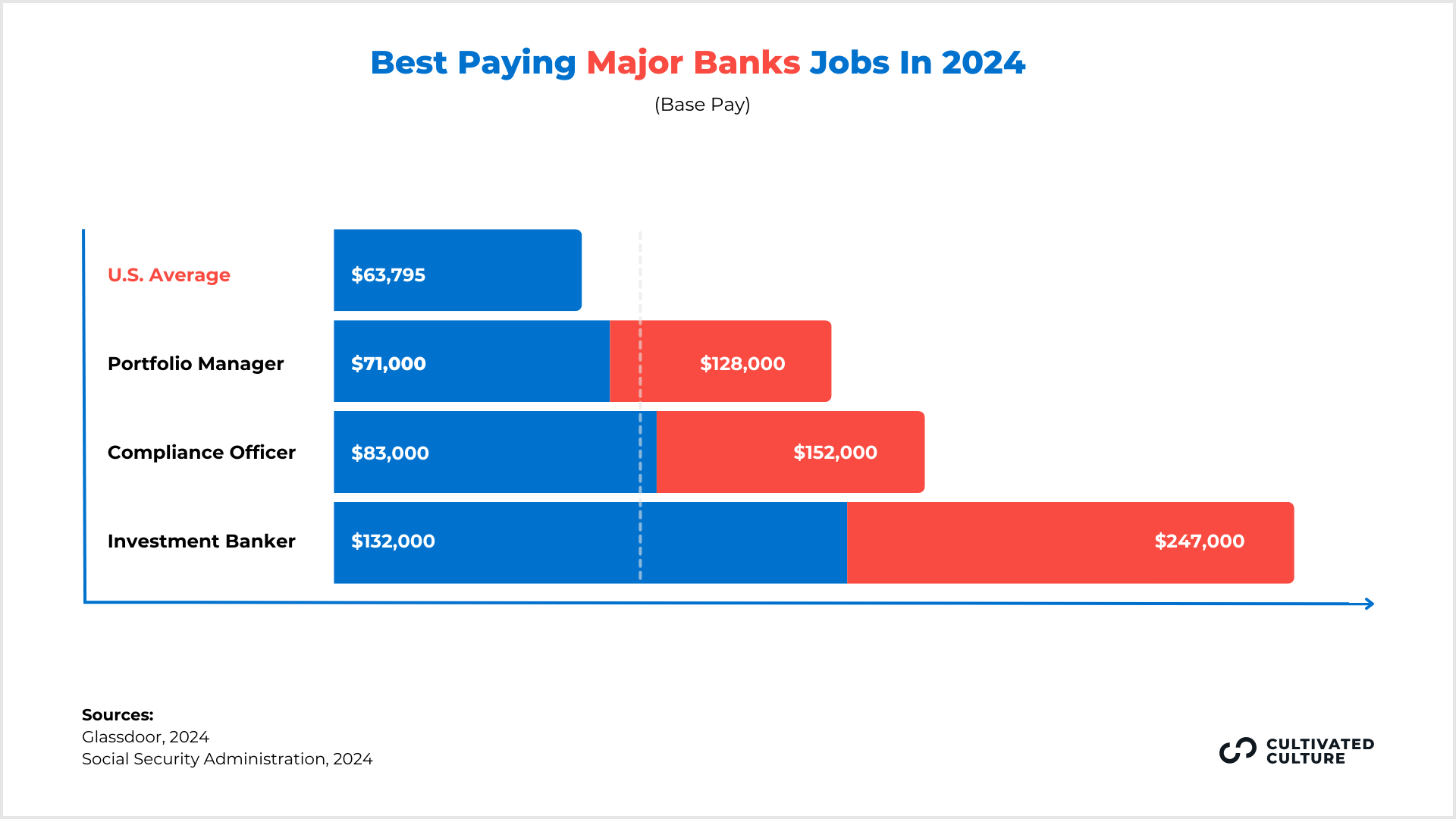

According to Glassdoor, the base salary for the most common major banks industry jobs in 2024 are:

- Bank Teller: $38K – $53K / year base pay (USD)

- Personal Banker: $44K – $66K / year base pay (USD)

- Branch Manager: $60K – $95K / year base pay (USD)

- Investment Banker: $132K – $247K / year base pay (USD)

- Financial Analyst: $63K – $100K / year base pay (USD)

- Portfolio Manager: $71K – $128K / year base pay (USD)

- Risk Analyst: $63K – $117K / year base pay (USD)

- Compliance Officer: $75K – $115K / year base pay (USD)

- Internal Auditor: $71K – $104K / year base pay (USD)

Best Paying Jobs In Major Banks Compared To The Average U.S. Salary In 2024

Now, let's check what that looks like compared to the average U.S. salary.

According to the Social Security Administration, the average salary in the U.S. is $63,795.

This is what the best-paying jobs in the major banks industry look like when we put them in perspective:

Portfolio Manager, Compliance Officer, and Investment Banker are the highest-paying roles in the major banks industry, with an earning potential of up to 287% higher than the U.S. average.

Is Major Banks A Good Career Path? (Our Verdict)

Major banks offer a promising career path for individuals interested in finance, risk management, and customer service.

Roles in this industry provide essential services that support the global economy. Companies like JPMorgan Chase, HSBC, and Mitsubishi UFJ Financial Group lead the field.

If you feel like this might be the career path for you, then be sure to dive into the next section where we cover the best strategies to help you land a job in the field:

How To Build A Job-Winning Major Banks Resume

Here's a fact most people don't usually realize: you don't need traditional experience to take on a new role.

You can leverage your unique background, experiences, and skills for nearly any position, as long as you sell it.

Think about your resume as an advertisement for yourself. Like any ad, you want it to be compelling and visually attractive, right?

That's exactly what you will do with your resume!

1. Leveraging The Best Keywords For Your Target Role

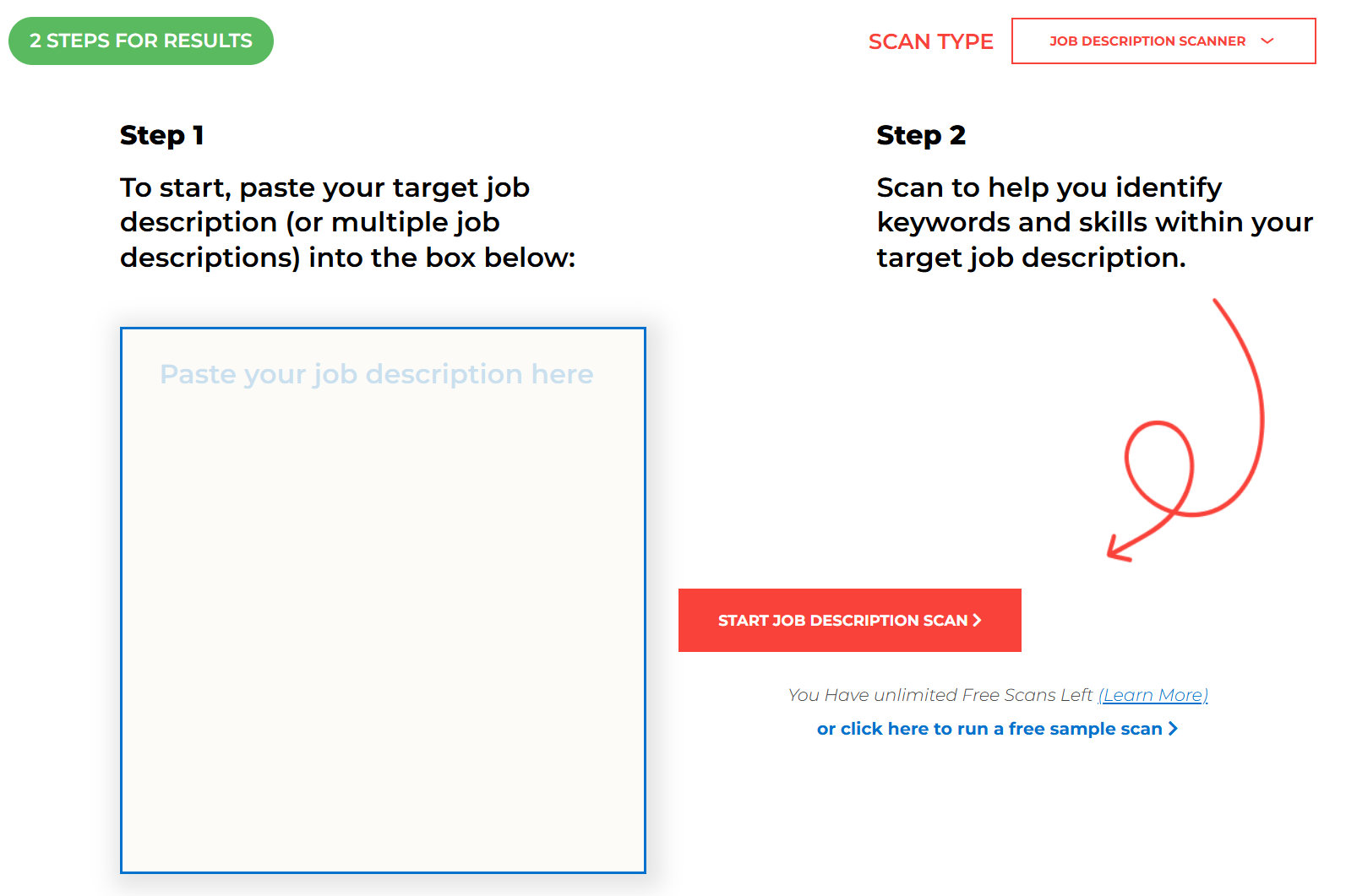

Remember ResyMatch.io, that resume and job description scanner tool we mentioned earlier in this article?

We first showed you how you can scan and compare your resume with your target job description to find out how your skills match the role.

However, if you don't have a resume yet, you can still get great insight from this tool by running a job description scan.

Here's how: head over to ResyMatch.io and, in “Scan Type,” select “Job Description Scanner.” Then, copy the job description for your target role and paste it into the box on the left.

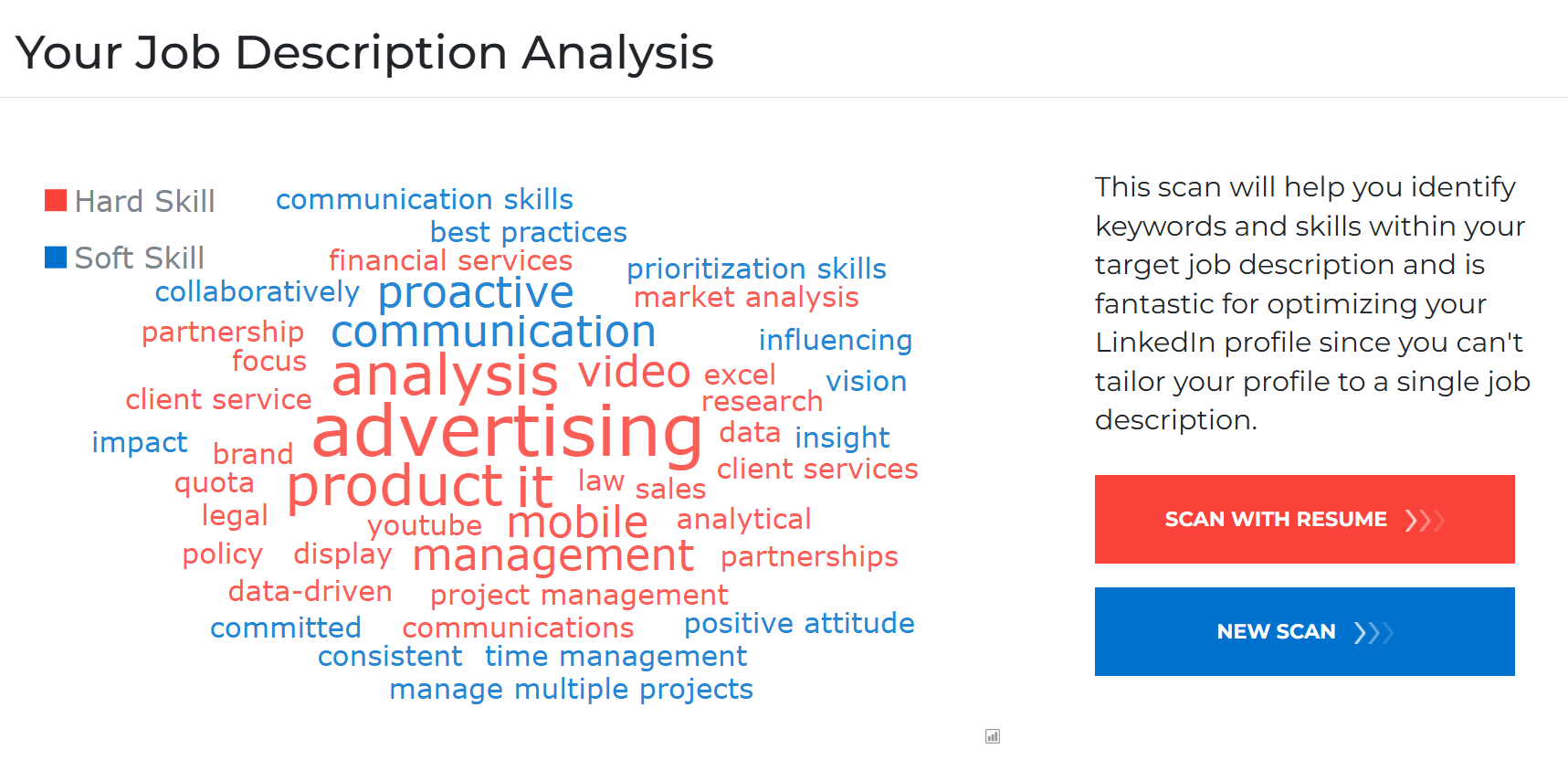

ResyMatch.io will provide a list of hard and soft skills that apply to the role. You can use these skills as keywords when building your resume.

Skim through the list to get ideas for keywords you can leverage on your resume.

For example, let's say you are an analytical and detail-oriented individual. Are there any previous experiences, personal projects, or even academic achievements that you can showcase in your resume to highlight these skills?

If yes, then make sure to include those on your resume and then move on to the next step:

2. Writing Compelling Resume Bullets

This is where you'll start crafting a resume that sells!

You'll want your resume bullets to have just the right amount of hard and soft skills, action words, measurable results, and common words.

This means a compelling major banks industry resume bullet for someone applying for a Financial Analyst role might look something like this:

Enhanced forecasting accuracy by 15% and identified $1M in cost-saving opportunities through financial modeling.

This bullet focuses on specific hard and soft skills that apply to a Financial Analyst, while also showcasing measurable results!

To help you write the perfect resume bullet, we've created ResyBullet.io, a free resume bullet analyzer that helps you write your resume in a way that grabs attention and illustrates value. Simply copy and paste your resume bullet below to begin your analysis:

ResyBullet will analyze and score your resume bullet and give you actionable insights for improvement.

Here's how our major banks industry resume bullet scored on ResyBullet:

If you're a visual learner, check out our video that walks you through the step-by-step of writing a crazy-effective resume bullet:

https://youtu.be/Om3MTf6oE5k?feature=shared

3. Make Your Resume Visually Appealing

The last step is to take all of your content and apply it to a layout that is both easy to read and visually appealing. We recommend using a resume template so you can save the time you would normally spend designing your resume and instead allocate it to other high-value activities in your job search (like interview prep and networking).

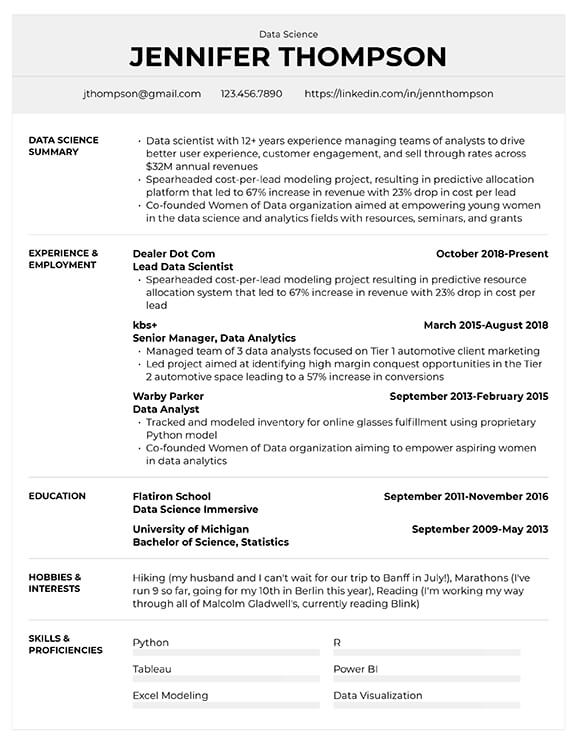

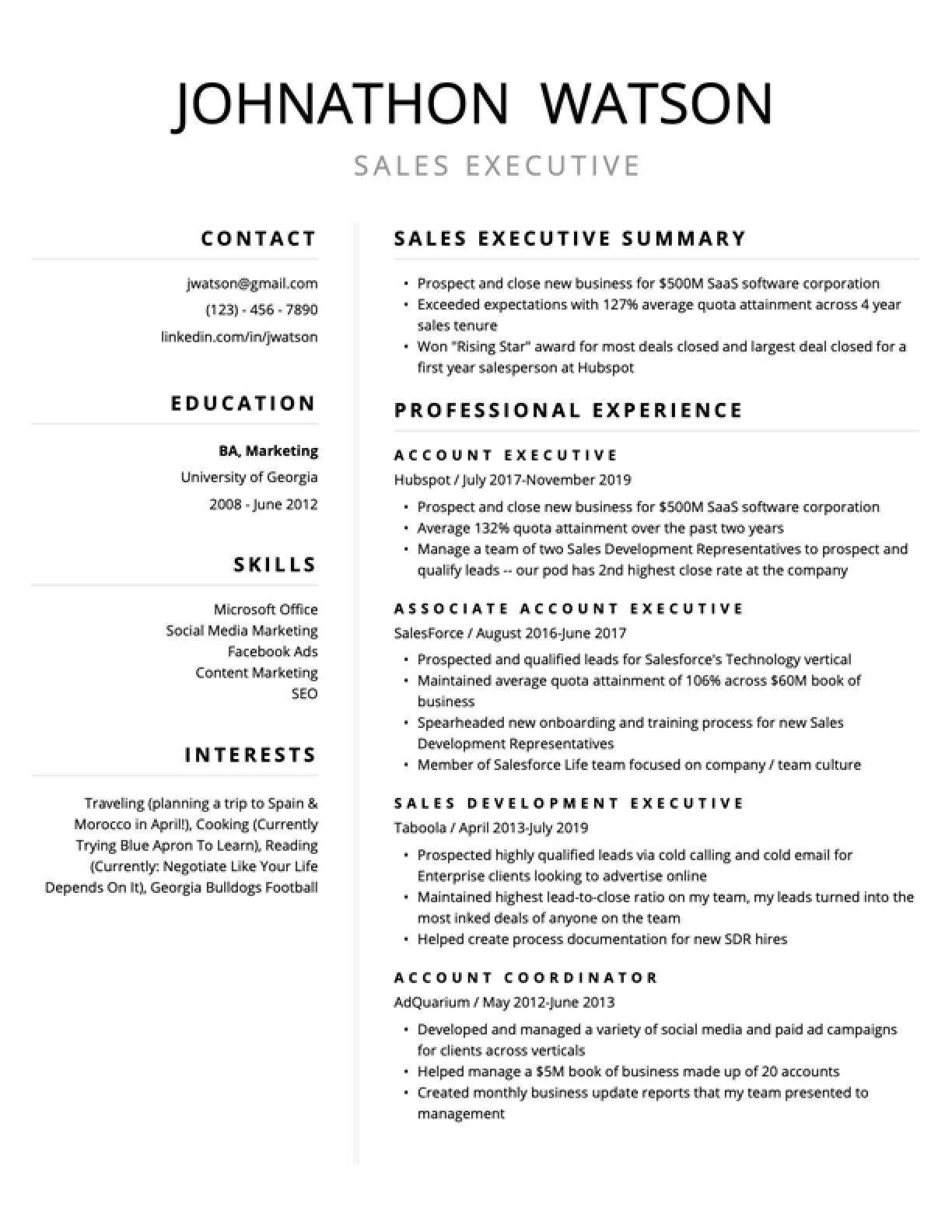

You can use ResyBuild.io, a free resume builder, to easily build and customize your resume in no time. Just pick one of the templates below and get started:

Free Job-Winning Resume Templates, Build Yours In No Time.

Choose a resume template below to get started:

Choose from 8 proven templates and easily create, edit, and customize your resume. ResyBuild's AI assistant also helps you craft personalized, job-winning bullets in a single click. Simply add your experience, hit “Optimize,” and watch the magic happen.

Ready To Pursue A Major Banks Career Path?

Then check out our No Experience, No Problem course and access a proven framework for building the skills and results you need to break into a new industry (even if you have absolutely no relevant experience right now)!