So you decided to pursue a Financial Advisor career path and are curious about what your career may look like in a few years?

Or, maybe, you're still deciding if a Financial Advisor career path is the right track for you.

Either way, we've got you covered! In this article, we'll be sharing:

- Financial Advisor Careers To Pursue

- The Financial Advisor Career Path: Roles, Skills, & Progression

- Financial Advisor Salaries (Entry-Level, Mid-Level, & Senior Level)

- Level-Up Your Game: How To Step Into A New Financial Advisor Role

Financial Advisor Careers To Pursue

There are several different career opportunities you can explore in the financial advisory field. However, different industries and clients might require more expertise in specific areas.

For example:

- A Financial Advisor role at a wealth management firm might focus heavily on portfolio management, estate planning, and tax optimization for high-net-worth individuals.

- A Financial Advisor role at a bank could emphasize retirement planning, savings products, and investment strategies to serve a broad range of clients.

- A Financial Advisor role at a fintech startup could involve digital financial planning, robo-advisory tools, and innovative investment models to make financial guidance more accessible.

Not all companies will demand every specialty, but every specialty has a place within many different firms!

So, if you're thinking about which Financial Advisor career path you should pursue, it might be a good idea to first consider what kind of company or client base you would like to work with.

Maybe you'd like to work for a prestigious investment firm.

Maybe you're aiming for a community bank or credit union.

Or, maybe, you'd like to join a fintech startup disrupting the industry.

You will find different financial advisory opportunities with different scopes and setups. Having clarity about where you'd like to be within a certain time frame is key to deciding which path is right for you.

Most skills you need for a Financial Advisor career path are transferable across different roles, industries, and clients. The purpose of the exercise is so you can look at the opportunities on your horizon and decide where you'd like to be in the short term and eventually down the road!

💡 Pro Tip:

If you're struggling to find out where you'd like to be, check out the article “What Should I Do With My Life? A Step-By-Step Guide” and read it from top to bottom. If “Financial Advisor” still feels like the right path, head back here and continue reading!

Once you've set your mind on your career path, it's time to understand what roles might be a good fit for you.

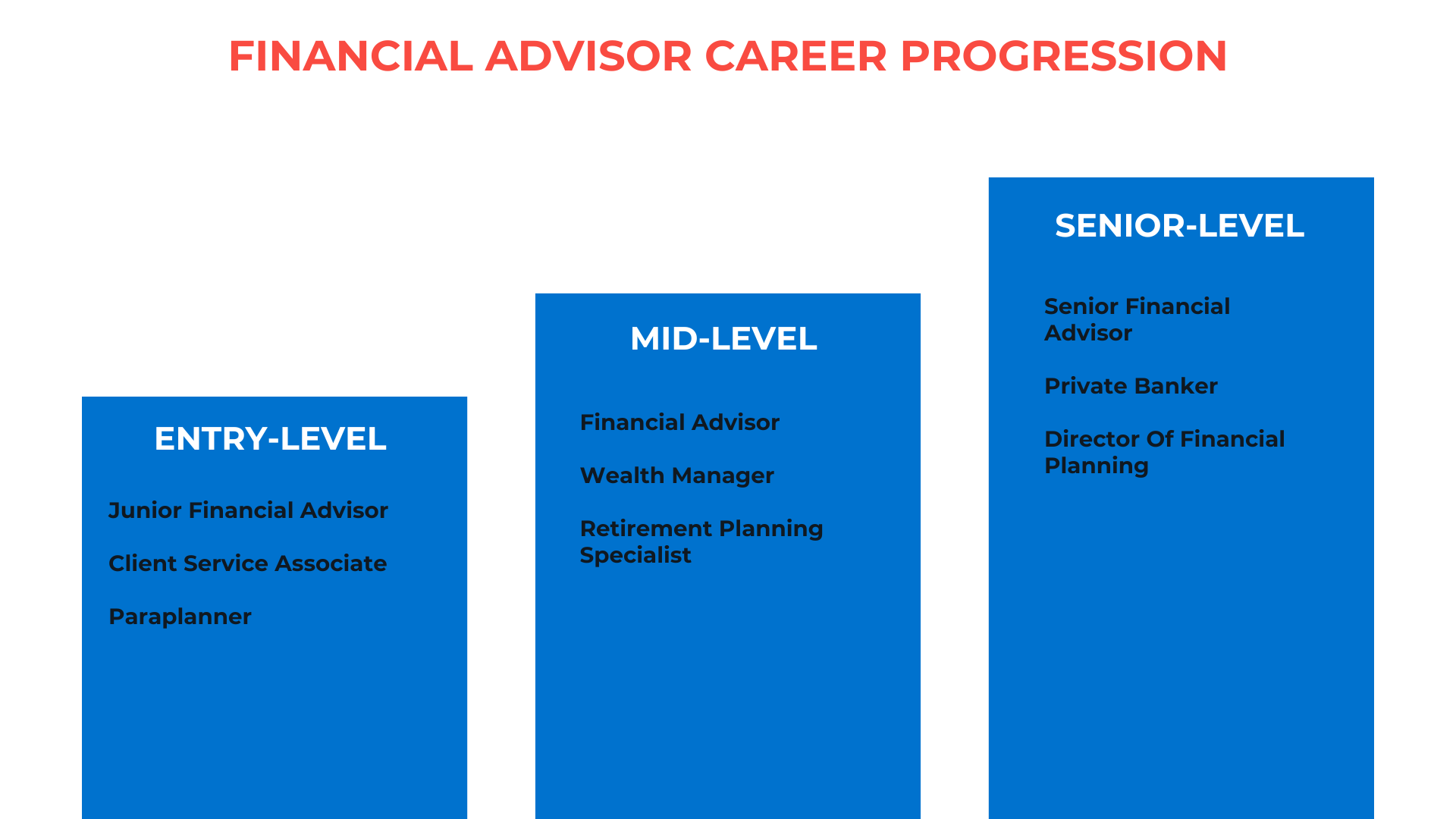

The Financial Advisor Career Path: Roles, Skills, & Progression

We've selected the most common Financial Advisor roles for each level and their job descriptions. Take a look below!

Entry-Level Financial Advisor Roles

Most people begin their financial advisory careers in specialist roles, such as:

Junior Financial Advisor

This role offers broad exposure to financial planning and client service and doesn't usually require extensive experience.

📝 Junior Financial Advisor Job Description: Responsible for assisting senior advisors with client portfolios, preparing financial plans, and providing general financial guidance.

✅ Skills Required: Knowledge of financial products, interpersonal skills, analytical ability, and sales aptitude.

⬆️ Possible progression: Junior Advisors can progress into full Financial Advisor roles.

Client Service Associate

This role requires supporting advisors with client onboarding, account management, and administrative tasks.

📝 Client Service Associate Job Description: Responsible for handling client inquiries, preparing account paperwork, and supporting advisors with day-to-day tasks.

✅ Requirements: Strong customer service, organization, and basic finance knowledge.

⬆️ Possible progression: Client Service Associates can move into Junior Advisor or Paraplanner roles.

Paraplanner

This role supports financial advisors with planning, research, and report preparation.

📝 Paraplanner Job Description: Responsible for preparing financial plans, conducting research on products, and ensuring compliance with regulations.

✅ Requirements: Analytical skills, financial planning knowledge, and attention to detail.

⬆️ Possible progression: Paraplanners can progress into Financial Advisor or Senior Paraplanner roles.

Mid-Level Financial Advisor Roles

As you gain experience, mid-level roles often involve managing clients independently and building relationships. Some common mid-level financial advisor roles include:

Financial Advisor

At this level, professionals are responsible for advising clients on investments, retirement planning, insurance, and wealth management strategies.

📝 Financial Advisor Job Description: Responsible for building client portfolios, recommending financial products, and ensuring clients reach their financial goals.

✅ Skills Required: Financial planning, sales, communication, and regulatory knowledge.

⬆️ Possible progression: Financial Advisors can advance to Senior Financial Advisor roles.

Wealth Manager

This role focuses on high-net-worth clients and requires deep knowledge of advanced investment and tax strategies.

📝 Wealth Manager Job Description: Responsible for providing personalized financial advice, estate planning, and asset allocation.

✅ Skills Required: Investment knowledge, estate planning, tax optimization, and relationship management.

⬆️ Possible progression: Wealth Managers can move into roles such as Private Banker or Senior Wealth Manager.

Retirement Planning Specialist

This role emphasizes retirement-focused financial planning and investment strategies.

📝 Retirement Planning Specialist Job Description: Responsible for helping clients build retirement plans, analyzing income needs, and managing risk.

✅ Skills Required: Knowledge of retirement products, actuarial principles, and long-term financial modeling.

⬆️ Possible progression: Retirement Planning Specialists can move into Senior Advisor or Practice Lead roles.

Senior-Level Financial Advisor Roles

Senior-level roles involve strategic oversight, leadership, and managing high-value clients.

Senior Financial Advisor

Senior Advisors are responsible for managing large client books, mentoring junior advisors, and developing advanced strategies.

📝 Senior Financial Advisor Job Description: Responsible for overseeing financial plans, guiding complex investment strategies, and retaining high-value clients.

✅ Skills Required: Leadership, advanced financial planning, investment management, and compliance.

⬆️ Possible progression: Senior Financial Advisors can move up to roles like Director of Financial Planning.

Private Banker

This role focuses on ultra-high-net-worth clients and requires deep knowledge of investments, trusts, and global wealth management.

📝 Private Banker Job Description: Responsible for providing personalized investment strategies, estate solutions, and private banking services.

✅ Skills Required: Investment banking, wealth management, estate law, and relationship management.

⬆️ Possible progression: Private Bankers can advance to roles like Head of Private Banking.

Director of Financial Planning

This role oversees the financial advisory practice and manages teams of advisors.

📝 Director of Financial Planning Job Description: Responsible for setting advisory strategy, managing staff, ensuring compliance, and growing client assets under management.

✅ Skills Required: Leadership, business strategy, compliance, and advanced financial knowledge.

⬆️ Possible progression: Directors can move up to executive roles such as Chief Investment Officer (CIO) or Partner.

Financial Advisor Salaries (Entry-Level, Mid-Level, & Senior Level)

Now that we’ve covered the most common financial advisor career paths, you might be asking yourself what the pay range is for each role.

To answer this question, let’s head over to one of our favorite tools for salary research: Glassdoor.

According to Glassdoor, the base salary for the most common financial advisor roles in 2026 are:

Financial Advisory Roles:

- Junior Financial Advisor (Entry-Level): $71K – $133K / year base pay

- Financial Advisor (Mid-Level): $76K – $141K / year base pay

- Senior Financial Advisor (Senior-Level): $76K – $142K / year base pay

Wealth Management Roles:

- Paraplanner (Entry-Level): $49K – $89K / year base pay

- Wealth Manager (Mid-Level): $77K – $144 / year base pay

- Private Banker (Senior-Level): $88K – $164K / year base pay

Leadership Roles:

- Client Service Associate (Entry-Level): $47K – $73K / year base pay

- Retirement Planning Specialist (Mid-Level): $58K – $102K / year base pay

- Director of Financial Planning (Senior-Level): $123K – $193K / year base pay

Level-Up Your Game: How To Step Into A New Financial Advisor Role

Whether you're looking for an entry-level job in financial advising or aiming to advance in your financial advisory career, it's important to know that you don't necessarily need a graduate degree or specialization to move up the financial advisor career ladder. Your unique experience and skills can go a long way, as long as you learn how to sell them!

Here are a few tips and tricks that will help you land your next financial advisor role.

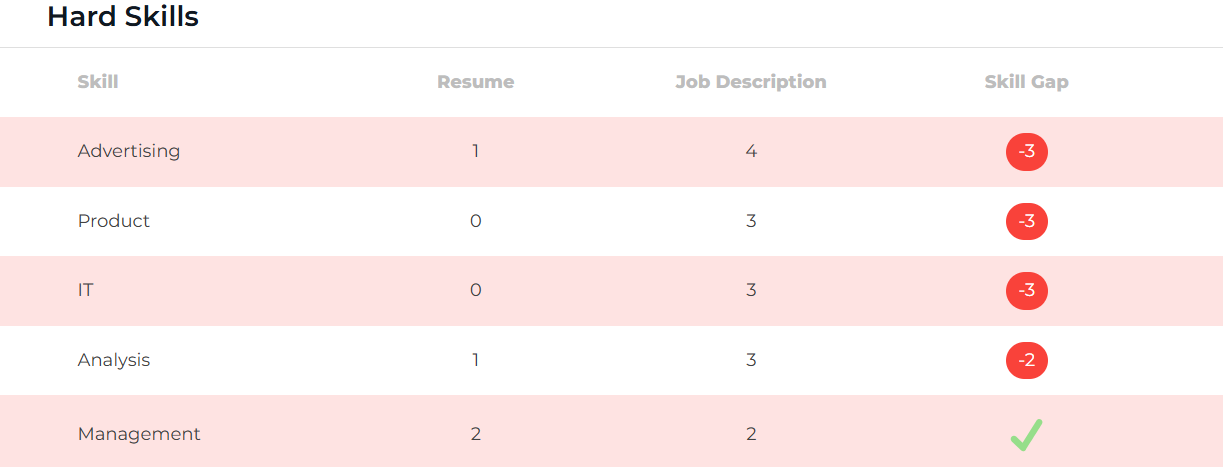

1. Run A Resume Scan To Find Out Skill Gaps In Your Target Role

Wondering if you are the right fit for that target role you've been eyeing?

We've got you covered.

Here's a simple, step-by-step guide to find out if you have the skills to land a job in financial advising:

- Copy the job description of the Financial Advisor role that sparked your interest

- Head over to ResyMatch.io (or use our shortcut below)

- Grab a copy of your most updated resume

- Upload your resume on the left side

- Paste the job description on the right side

- Hit “Start Resume Scan”

Boom! ResyMatch will compare and score your resume against the job's description and identify missing skill gaps, such as:

ResyMatch will also make sure your resume is ATS compatible. And of course, ResyMatch will provide suggestions and outline best practices you can use to edit and improve your resume!

Use our shortcut below to get started:

2. Update Your Resume With Compelling Resume Bullets

After you've compared your resume against your target job description, you will likely find yourself in one of two scenarios:

1. You have some missing skills that you'll need to master before taking on a new role — if that's the case, you can take action and start building those skills through online courses and a portfolio strategy.

OR…

2. You have already mastered most of the skills — if that's the case, all you need to do is update your resume with compelling resume bullets, leveraging the keywords found in your resume and job description scan.

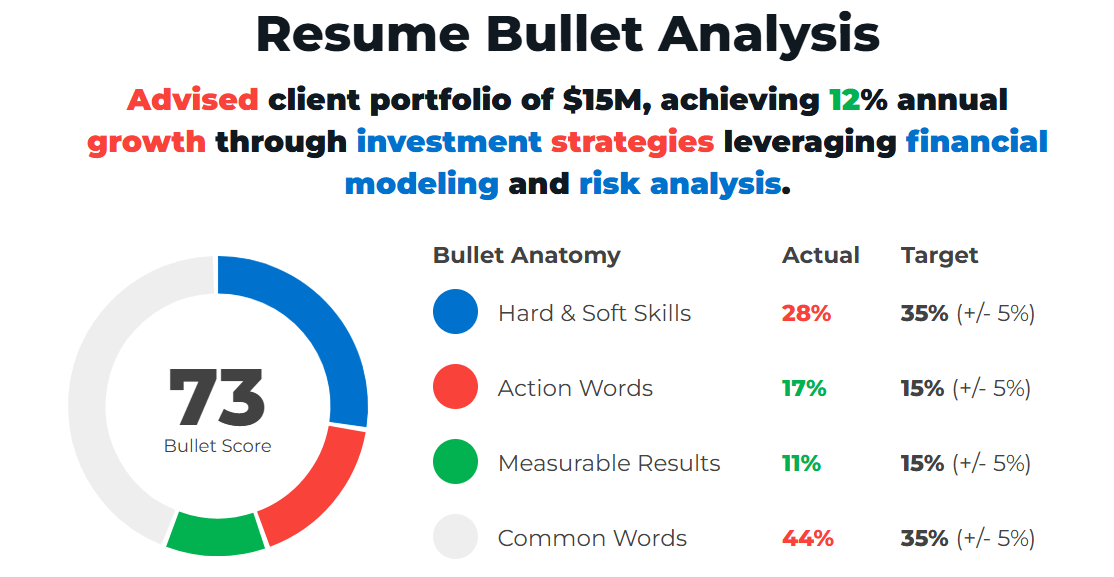

To get started, you'll want your resume bullets to have just the right amount of hard and soft skills, action words, measurable results, and common words.

This means a compelling resume bullet for someone applying for a Financial Advisor role might look something like this:

Advised client portfolio of $15M, achieving 12% annual growth through investment strategies leveraging financial modeling and risk analysis.

This bullet focuses on financial advisory–specific skills while also showcasing measurable results!

To help you write the perfect resume bullet, we've created ResyBullet.io, a free resume bullet analyzer that helps you write your resume in a way that grabs attention and illustrates value. Simply copy and paste your resume bullet below to begin your analysis:

ResyBullet will analyze and score your resume bullet and give you actionable insights for improvement.

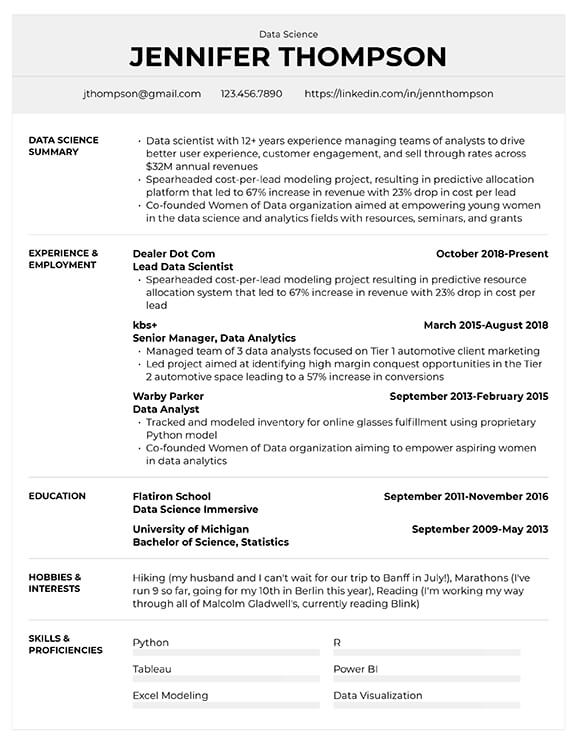

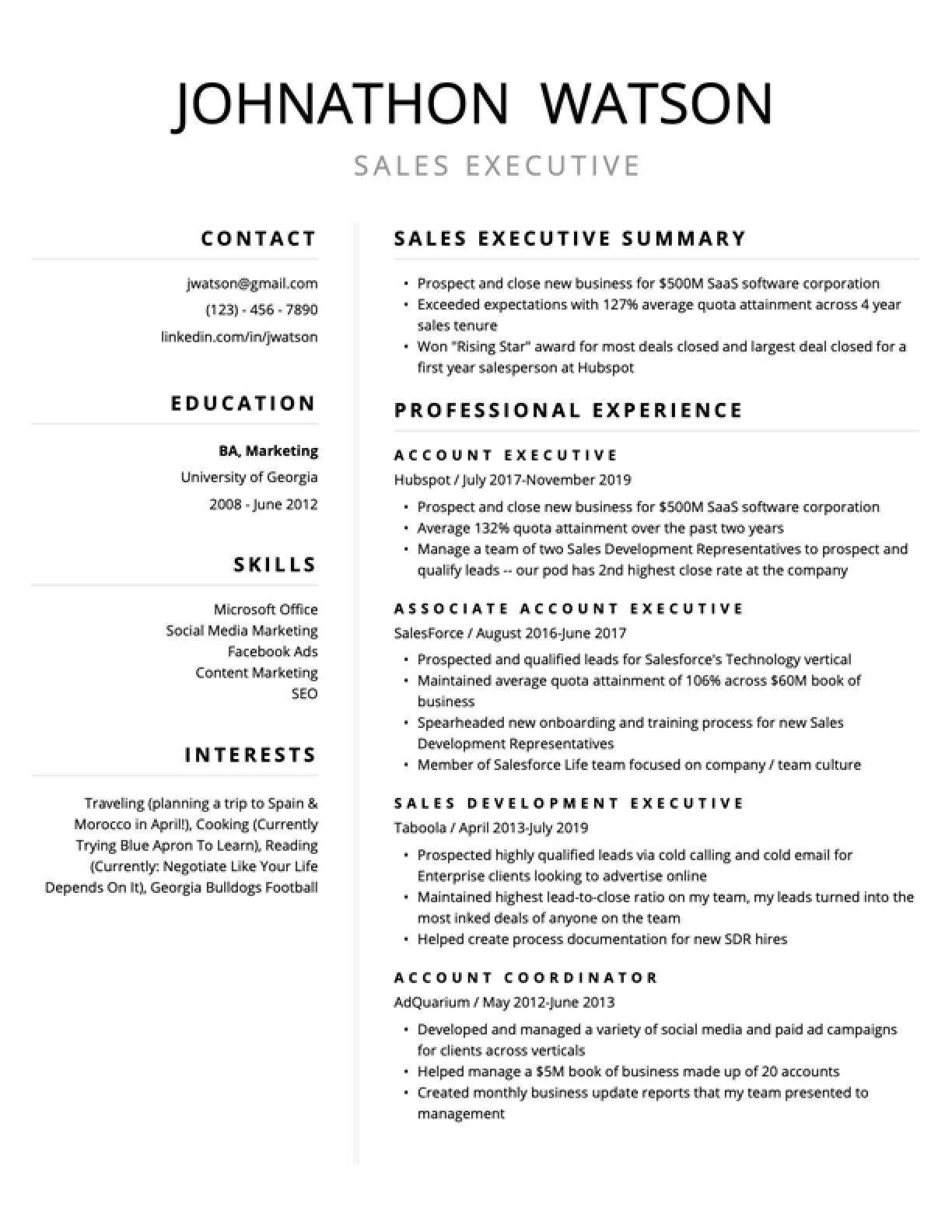

Here's how our resume bullet scored on ResyBullet:

If you're a visual learner, check out our video that walks you through the step-by-step of writing a crazy-effective resume bullet:

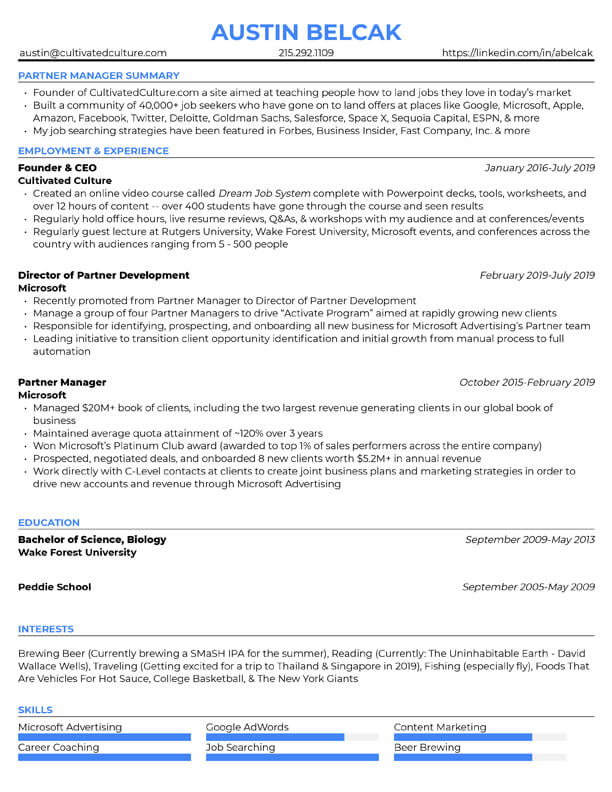

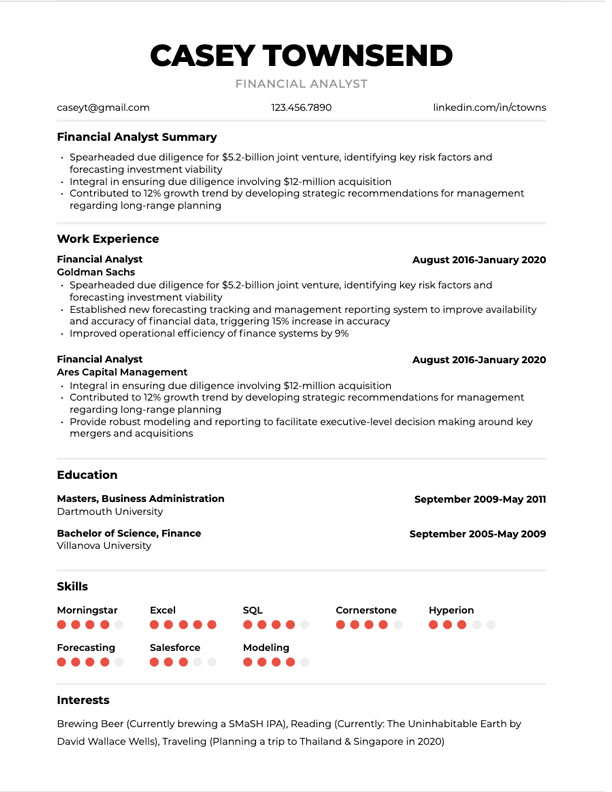

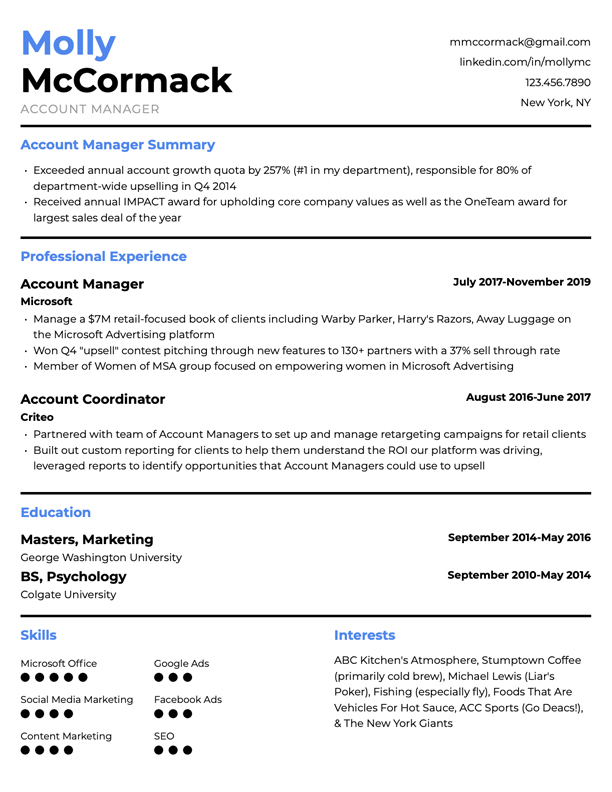

3. Build A Visually Appealing, ATS-Friendly Resume

Now that you've updated the content on your resume, it's time to transfer it over to an awesome layout that's also ATS-friendly.

We recommend using a resume template so you can save the time you'd normally spend designing your resume and instead allocate it to your job search.

You can use ResyBuild.io, a free AI resume builder, to easily build and customize your resume in no time. Just pick one of the templates below and get started:

Free Job-Winning Resume Templates, Build Yours In No Time.

Choose a resume template below to get started:

Choose from 8 proven templates and easily create, edit, and customize your resume. ResyBuild's AI assistant also helps you craft personalized, job-winning bullets in a single click. Simply add your experience, hit “Optimize,” and watch the magic happen.

4. Don't Apply Online — Do This Instead

The most common next step in the process is to start applying for Financial Advisor roles.

While applying online can absolutely be the next step in your job search, the truth is, it will only get you so far. In fact, only 2% of resumes submitted for the average open role end up reaching the interview stage.

Sure, optimizing your resume will boost your chances of being a part of that 2%.

But some estimates, like this one from the Wall Street Journal, show that 80% of hires come from referrals.

This means your best shot at landing the role you've been eying is through networking.

And no, we're not talking about attending conferences, events, and meetups. We're talking about a fresh approach that really builds relationships and gets your resume at the top of the resume pile at firms like Merrill Lynch, Morgan Stanley, Vanguard, and more.

You can read all about it in our flagship guide for effective job searching:

Read More: How To Get A Job Anywhere Without Applying Online

Final Notes

Whether you're just starting out or looking to advance in your Financial Advisor career, getting clarity on the possibilities ahead of you can help you navigate your career with more ease.

Just don't forget: your career path isn't set in stone. Jobs and career goals will often evolve with life transitions. Always remember that your career should adapt to fit your life and not the other way around.